Introduction

The government has clarified rules of invoicing under GST along with a template of invoice (GST INV-01) covering particulars like supplier’s details, GST tax rates etc. As per the rules, the invoice has to be issued within 30 days of rendering the service and in case of banks and NBFCs, it has to be issued within 45 days. Let us understand these in detail.

- GST Framework

- Intra State Sale – For Intra State Sale, Tax will be divided in two components i.e CGST and SGST/UTGST

- Inter State Sale – For Inter State Sale, Tax will be charge in one component i.e IGST

- Particulars of Invoice

- All registered taxpayers are free to design their own invoice format under GST However, it is required that certain fields as mentioned in the invoice rules be incorporated in all invoices. Some of these fields are as follows:

- Name, address and GSTIN of the supplier;

- A consecutive serial number, in one or multiple series,

- Date of its issue;

- Name, address and GSTIN or UIN, if registered, of the recipient;

- Name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un-registered and where the value of taxable supply is fifty thousand rupees or more;

- HSN code of goods or Accounting Code of services;

- Description of goods or services;

- Quantity in case of goods and unit or Unique Quantity Code thereof;

- Total value of supply of goods or services or both;

- Taxable value of supply of goods or services or both taking into account discount or abatement, if any;

- Rate of tax (Central Tax, State Tax, Integrated Tax, Union Territory Tax or cess);

- Amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess);

- Place of supply along with the name of State, in case of a supply in the course of inter-State trade or commerce;

- Address of delivery where the same is different from the place of supply;

- Whether the tax is payable on reverse charge basis;

- Signature or digital signature of the supplier or his authorized representative etc.

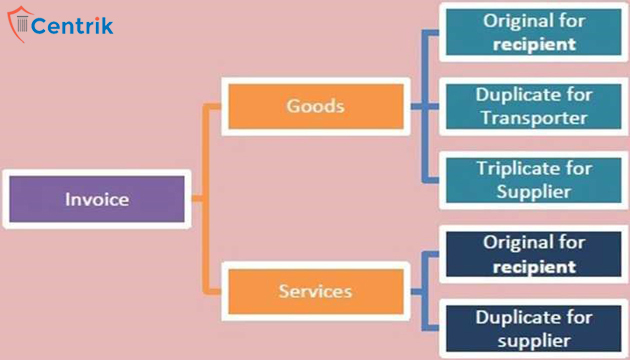

- Manner of issuing InvoiceInvoice under GST shall be issued in the following manner:

- Invoice Format

- Invoice in the Current Tax RegimeIn the current tax regime, Service tax invoice shows details of the service provider, registration ID, description of service, rate of Service Tax, abatement(if any), CESS namely Krishi Kalyan Cess@ 0.5% and Swachh Bharat Cess@ 0.5% and other particulars. A sample invoice is shown below:

Attached herewith is the link of format : Service-Tax-Invoice

- Invoice in the GST regimeWhen a registered taxable person provides taxable services, a tax invoice is issued. Attach herewith is the format of issuing invoice under GST- GST-Invoice

Note – Please note that the above article is part of our continuous research on the related matters. It is based on our interpretation of related regulations which may differ person to person. Readers are expected to take expert opinion before relying on above.

join For Updates

join For Updates

Is It mandatory to mention the words “Tax invoice” on the GST Invoice ? If Yes than can you please state according to which section or rule or case law?

Thanks in advance.