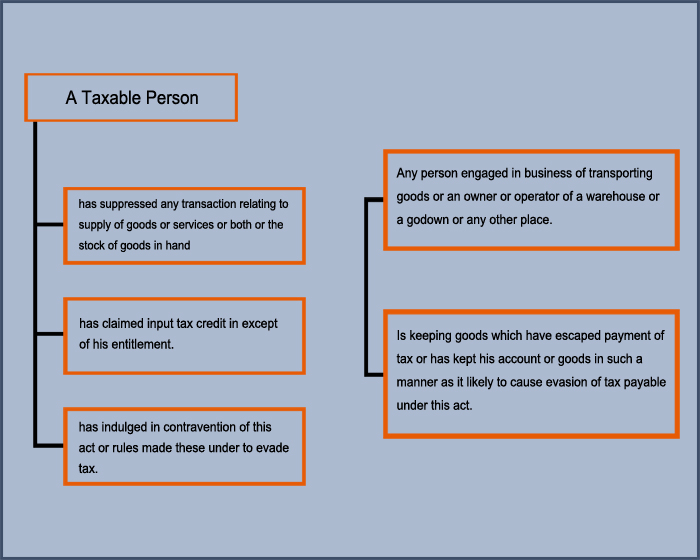

“Inspection” means, careful examination or scrutiny. Under Goods and Services Tax (GST), there is a provision of inspection which acts as a deterrent for tax evasion. These provisions help restricting tax evaders gain the unfair advantage over authentic tax payers. Chapter XIV of the Central Goods and Services Tax Act, 2017 deals with the provisions of Inspection, Search, Seizure, and Arrest. Section 67 of CGST Act, 2017 read with Rules states that where the proper officer, not below the rank of Joint Commissioner, has reasons to believe that

The officer may authorize in writing any other officer of Central tax or State tax to inspect any places of business of the taxable person or the persons engaged in the business of transporting goods or the owner or the operator of warehouse or godown or any other place. The authorization to conduct the inspection or search or, as the case may be, seizure of goods, documents, books or things liable to confiscation will be in form GST INS- 01

Note – Please note that the above article is part of our continuous research on the related matters. It is based on our interpretation of related regulations which may differ person to person. Readers are expected to take expert opinion before relying on above.

join For Updates

join For Updates