There may be the situation where we have to reverse the sale made and the invoice shown in GST return. For this, supplier has to issue credit note to the recipient of goods or services. Section-34 of CGST Act deals with issuance of credit note and debit note under GST.

Section 34 of CGST Act says that –

Where a tax invoice has been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to exceed the taxable value or tax payable in respect of such supply, or where the goods supplied are returned by the recipient, or where goods or services or both supplied are found to be deficient, the registered person, who has supplied such goods or services or both, may issue to the recipient a credit note containing such particulars as may be prescribed.

Below are the few situations where one can issue credit note.

- Supplier has incorrectly declared a value which is more than the actual value of the goods or services provided.

- The supplier has incorrectly declared a higher tax rate than what is applicable for the kind of the goods or services or both supplied.

- The quantity received by the recipient is less than what has been declared in the tax invoice.

- The quality of the goods or services or both supplied is not to the satisfaction of the recipient thereby necessitating a partial or total reimbursement on the invoice value.

- Any other similar reasons.To regularize these sorts of conditions, the supplier is permitted to issue what is called as credit note to the beneficiary. Once the credit note has been issued, the tax liability of the supplier will decrease.

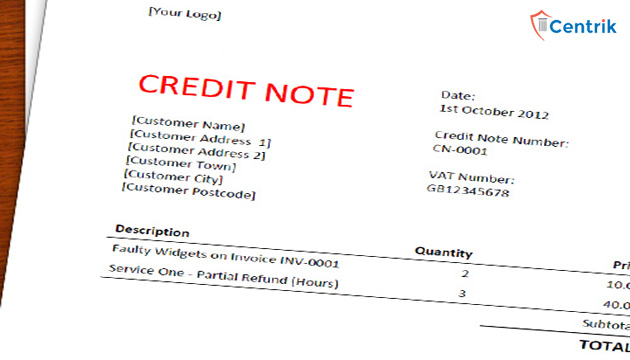

Format of Credit Note

There is no prescribed format but credit note issued by a supplier must contain the following particulars, namely:

(a) Name, address and GST no. of the supplier.

(b) Nature of the document.

(c) A consecutive serial number not exceeding sixteen characters.

(d) Date of issue.

(e) Details of recipient with GST no., if any.

(f) Serial number and date of the corresponding tax invoice or, as the case may be, bill of supply;

(h) Value of taxable supply of goods or services, rate of tax and the amount of the tax credited to the recipient

(i) Signature or digital signature of the supplier or his authorised representative.

Period of Retention of Records

Section-36 of CGST Act says that, the records of the credit have to be retained until the expiry of seventy-two months from the due date of furnishing of annual return for the year pertaining to such accounts and records.

Where such accounts and documents are maintained manually, it should be kept at every related place of business mentioned in the certificate of registration and shall be accessible at every related place of business where such accounts and documents are maintained digitally.

Conclusion

The credit note is therefore a convenient and legal method by which the value of the goods or services in the original tax invoice can be amended or revised. The issuance of the credit note will easily allow the supplier to decrease his tax liability in his returns without requiring him to undertake any tedious process of refunds.

Disclaimer – the above summary is based on the personal interpretation of the revised regulations, which may differ person to person. Hence, the readers are expected to take expert opinion before placing reliance on this article.

join For Updates

join For Updates