As India is moving towards digitization, GST has provided an easy and simple way of payment of taxes. Under GST regime, all the taxpayers will get three electronic ledgers namely E-cash Ledger, E-credit Ledger & E-liability Ledger through their GST profile.

E-cash Ledger:

The electronic cash ledger under sub-section (1) of section 49 shall be maintained in FORM GST PMT-05 for each person, liable to pay tax, interest, penalty, late fee or any other amount, on the common portal for crediting the amount deposited and debiting the payment therefrom towards tax, interest, penalty, fee or any other amount. Thus, Payment can be made in cash by debiting the cash ledger maintained on the common portal.

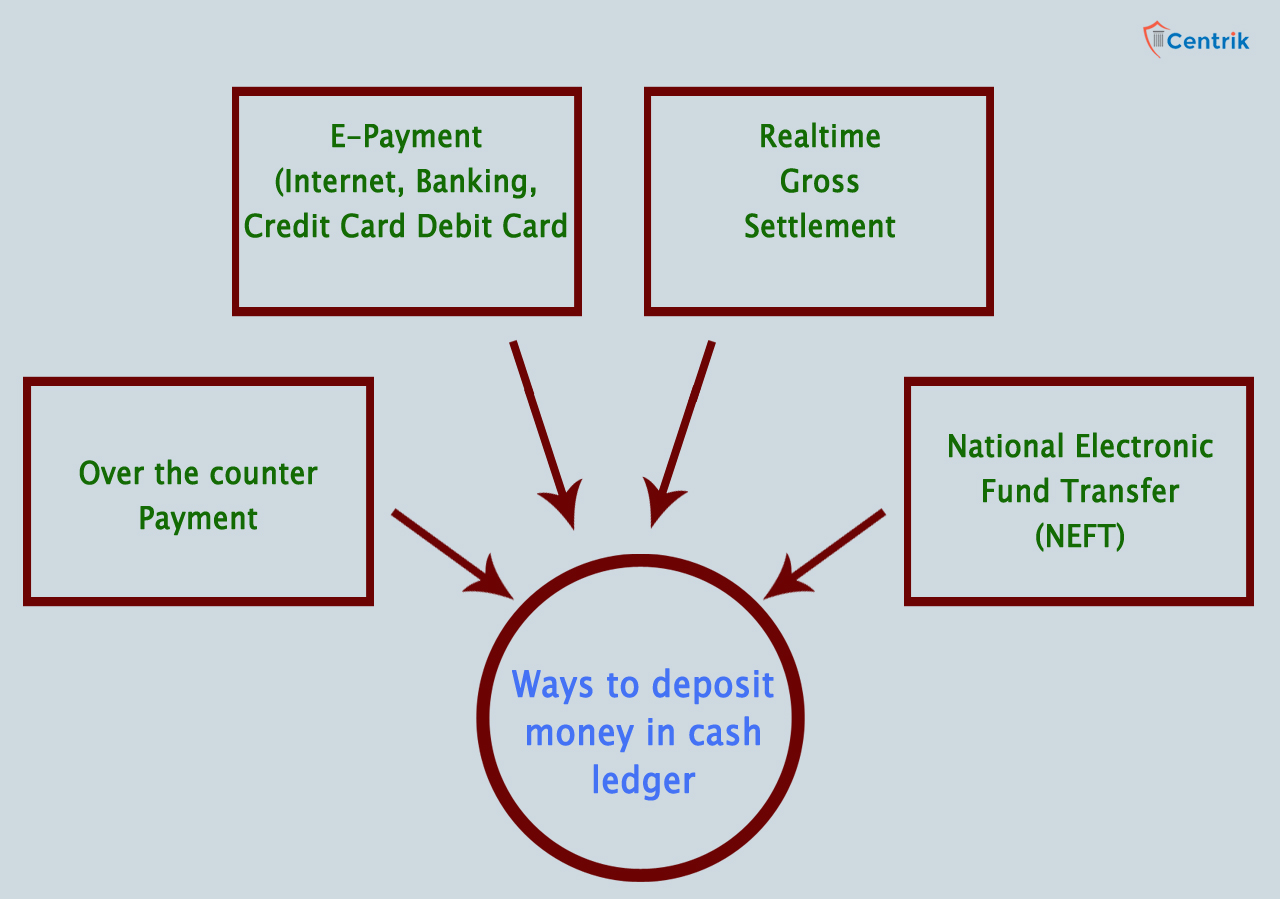

Money can be deposited in the Cash Ledger by modes as depicted in the above diagram. Over the Counter, Payment can be made in branches of Banks Authorized (for deposits up to ten thousand rupees per challan per tax period, by cash, cheque or demand draft) to accept a deposit of GST.A challan in FORM GST PMT-06 is required to be generated and the details of the amount to be deposited towards tax, interest, penalty, fees or any other amount will be entered in the challan. Challan in FORM GST PMT-06 generated at the Common Portal shall be valid for a period of fifteen days

E-Debit or Credit Ledger:

Every registered taxable person is required to record and maintain an electronic liability ledger in Form GST PMT- 01 and all amounts payable wall be debited in the said register. The electronic credit ledger shall be maintained in FORM GST PMT-02 for each registered person eligible for input tax credit under the Act on the Common Portal and every claim of input tax credit under the Act shall be credited to the said Ledger. Payment of every liability by a registered taxable person can be made by debiting the e-liability ledger or E- cash ledger Any amount of demand debited or amount of penalty imposed or liable to be imposed in the electronic tax liability register shall stand reduced to the extent of relief given by the appellate authority or Appellate Tribunal or court or if the taxable person makes the payment of tax, interest, and penalty specified in the show cause notice or demand order, the electronic tax liability register shall be credited accordingly.

Any payment required to be made by a person who is not registered under the Act shall be made on the basis of a temporary identification number generated through the Common Portal.

Note – Please note that the above article is part of our continuous research on the related matters. It is based on our interpretation of related regulations which may differ person to person. Readers are expected to take expert opinion before relying on above.

join For Updates

join For Updates