Overview

India’s car industry is one of the quickest developing on the planet and it is as of now the 6th biggest comprehensively. As indicated by a Society of Indian Automobile Manufactures (SIAM) report, yearly auto deals could achieve more than 9 million vehicles by 2020.

Let us discuss in this article the Impact of GST on Purchase / Sale of Used Vehicle. Since the transactions happen in different ways, broadly as below, we shall discuss the impact of GST accordingly.

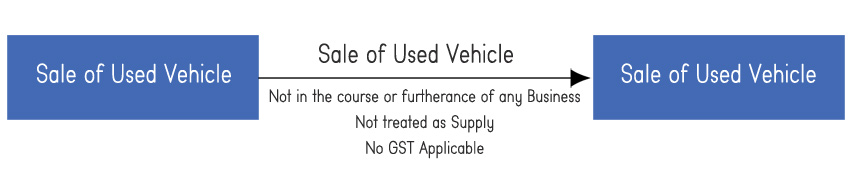

- Individual Sells to Individual (C2C):

As per Section 2(105) read with section 7 of CGST Act, 2017 even though the sale of old or used vehicle by an individual is for a consideration, it cannot be said to be in the course or furtherance of his business (as selling old vehicles is not the business of the said individual), and hence does not qualify to be a supply. Therefore sale by an individual to another individual is not a supply and no GST is applicable.

- Individual Sells to Un-registered Dealer (C2C):

This type of Transaction is similar one in the previous case, except that the buyer is in the course or furtherance of business. Individual selling to un-registered second hand vehicle dealer is not a supply and therefore no GST is applicable.

Though the unregistered buyer further makes resale of such vehicles is in the course or furtherance of business, GST is not payable as he is un-registered.

- Individual Sells to Register Second Hand Dealer (C2B):

Individual (unregistered) selling to Registered attracts payment of GST on Reverse Charge Mechanism under Sec 9(4) of CGST Act mandates that tax on supply of taxable goods (vehicle in this case) by an unregistered supplier (an individual in this case) to a registered person (the Second Hand Vehicle Dealer in this case) will be paid by the registered person (the Dealer in this case) under reverse charge mechanism.

- Applicability of Reverse Charge: If an unregistered supplier of old vehicles sell it to registered supplier, the tax under RCM will apply.

However Tax applicability on Reverse Charge on Purchases from Un-registered Dealers is suspended till 31st March, 2018. Notification No. 38/2017–Central Tax (Rate), 13th October, 2017. So the Registered dealer buying from un-registered individual need not pay GST on RCM till 31st Mar’2018.

- Registered Dealer Sells to Any Buyer (B2B / B2C):

If the supplier is a registered person and such supplier had purchased the Motor Vehicle prior to July 1, 2017 and has not availed input tax credit of central excise duty, Value Added Tax or any other taxes paid on such vehicles, then such vehicles when sold will attract GST of 65% of the applicable GST rate, including compensation cess.

These rates would apply for a period of three years with effect from 1 July 2017 ie applies up to 30th June 2020.

- Exchange of Old Vehicle with New Vehicle

Interestingly, sale of old and new cars is inextricably linked. It is estimated that about 27-28 percent of new car sales accrue through exchange of old models. So if new car sales are pegged at about 3 million, we could be looking at about 8, 40, 000 used cars being exchanged for new ones at pre-owned outlets.

In case exchange offers, the GST will be paid on the Transaction Value of the New Vehicle. For instance, if the new car costs Rs 10 lakh and exchange value of the old car is Rs 3 lakh, the customer will pay Rs 7 lakh but GST will be paid on Rs 10 lakh.

- GST on Leasing of Vehicle:

Vehicle leasing is the leasing a motor vehicle for a fixed period of time at an agreed amount of money for the lease. It is commonly offered by dealers as an alternative to vehicle purchase but is widely used by businesses as a method of acquiring vehicles for business, without the usually needed cash outlay. The key difference in a lease is that after the primary term (usually 2, 3 or 4 years) the vehicle has to either be returned to the leasing company or purchased for the residual value.

Leasing of vehicles purchased prior to 1 July will attract a tax equivalent to 65% of the current applicable goods and services tax (GST) rate for a period of 3 years.

Note – Please note that the above article is for education purpose only. This is based on our interpretation of laws which may differ person to person. Readers are expected to verify the facts and laws.

join For Updates

join For Updates