Value of supply is the value on which tax shall be levied. Section 15 of the Central GST Act 2017 states that the value of a supply of goods or services or both, shall be the transaction value.

Transaction value means

- price actually paid or payable for the said supply of goods or services or both

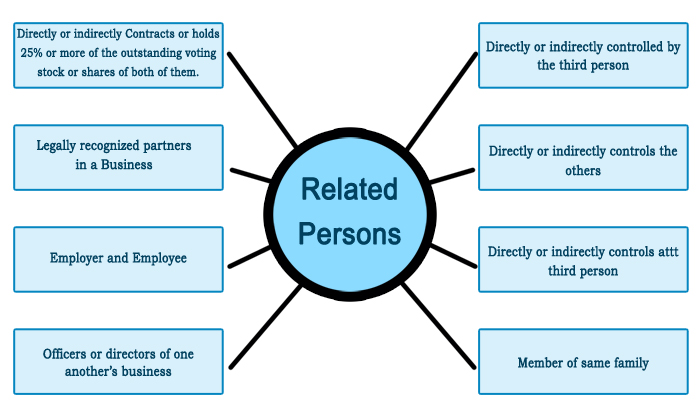

- where the supplier and the recipient of the supply are not related and

- the price is the sole consideration for the supply

|

Value of Supply |

|||

|

Includes |

Excludes Discount |

||

| Before or at the time of supply |

After the supply |

||

| 1. Any taxes, duties, cesses, fees and charges levied under any law for the time being in force other than CGST,SGST,UTGST and GST(Compensation to States) Act, 2017 | 1. If discount has been duly recorded in invoice |

1. Such discount is established in terms of an agreement and specifically linked to relevant invoices 2. Input tax credit , attributable to discount have been reversed by recipient |

|

| 2. Any amount that the supplier is liable to pay, in relation to supply, incurred by the recipient and not included in the price actually paid | |||

| 3. Incidental expenses, charged by supplier from recipient or any amount charged to make the supply | |||

| 4. Interest or late fee or penalty for delayed payment of any consideration for any supply | |||

| 5. Subsidies directly linked to the price excluding subsidies provided by the Central Governments or State Governments | |||

Valuation rules will apply to those value of supplies which are not covered under section 15 of the CCiST Act, 2017.

Note – Please note that the above article is part of our continuous research on the related matters. It is based on our interpretation of related regulations which may differ person to person. Readers are expected to take expert opinion before relying on above.

join For Updates

join For Updates